-40%

PRE-FORECLOSURE FLORIDA TAX LIEN CERTIFICATE FOR LAND 1.01 AC COCOA, FL BREVARD

$ 264.02

- Description

- Size Guide

Description

PLEASE READ ENTIRE AUCTION BEFORE BIDDING. Read TERMS and CONDITIONS.READ BEFORE BIDDING!!!

=============================================================================================================================

WINNING BID+ 5 CLOSING DOCUMENTATION FEE

PAYMENT METHODS:

(DEBIT CARD/CREDIT VIA PAYPAL ONLY) (INVOICE WILL BE SENT TO YOU THROUGH PAYPAL)

MONEY ORDER, BANK CERTIFIED CHECK OR PERSONAL CHECK (MUST PROVIDE PROOF THAT PAYMENT WAS MAILED)

MUST MESSSAGE ME TO CONFIRM PAYMENT. PAYMENT MUST BE CONFIRMED WITHIN 24 HOURS OR ITEM WILL BE RELISTED

=============================================================================================================================

***DO NOT BID IF YOU ARE NOT PLANNING ON FOLLOWING THROUGH WITH PURCHASE***

(IF YOU WIN AUCTION AND DO NOT COMPLETE PURCHASE, AN UNPAID ITEM CASE WILL BE OPENED ON YOU)

NO FAKE ACCOUNTS!!!! NO 0 RATINGS PLEASE MESSAGE ME FIRST OR YOUR BID WILL BE CANCELLED

IF YOU HAVE LOW FEEDBACK , PLEASE MESSAGE ME FIRST OR YOUR BID MAYBE CANCELLED

Serious Bidders Only! Non-Payment of Auction may result the Suspension of your eBay Account

=============================================================================================================

This is a County Delinquent Taxes Sale. This is not for the property deed.

You are bidding on a lien (year 2020) that is secured by this parcel and may initiate the foreclosure process by applying a Tax Deed Application through the county at any time after 2 years have elapsed since April 1 of the year of the issuance of the lien and before the expiration of 7 years from the date of issuance in accordance with Florida Statute 197.502, Florida Statutes.

Grantee of Tax Deed entitled to immediate possession (Reference: Florida Statute 197.562)

Bid Early! The Seller reserves the right to close this listing at any time.

Serious Bidders Only! Non-Payment of Auction may result the Suspension of your eBay Account.

If You Have No or Low Feedback, Please contact me before bidding...

Buyer is advised to do any and all due diligence before bidding.

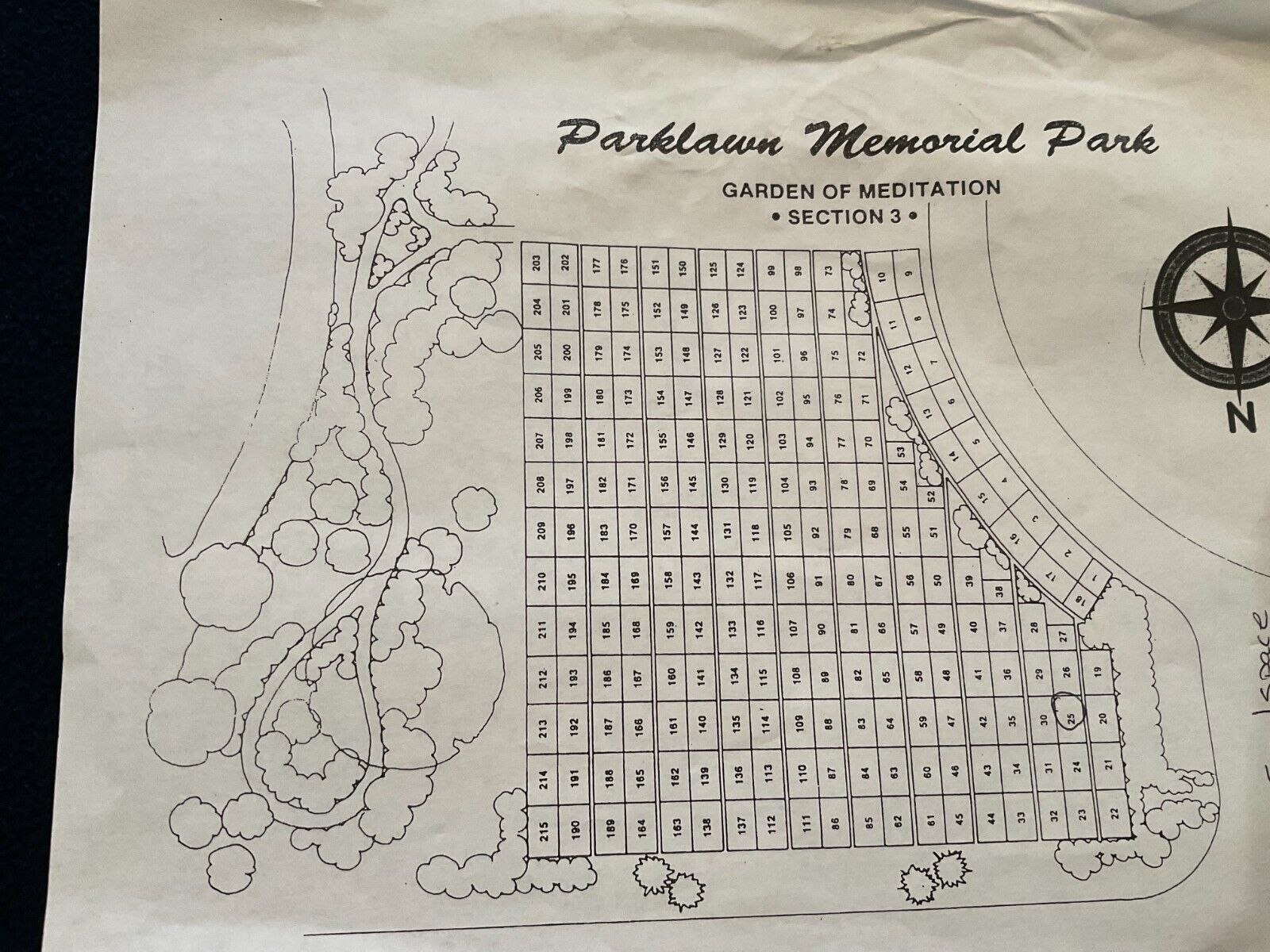

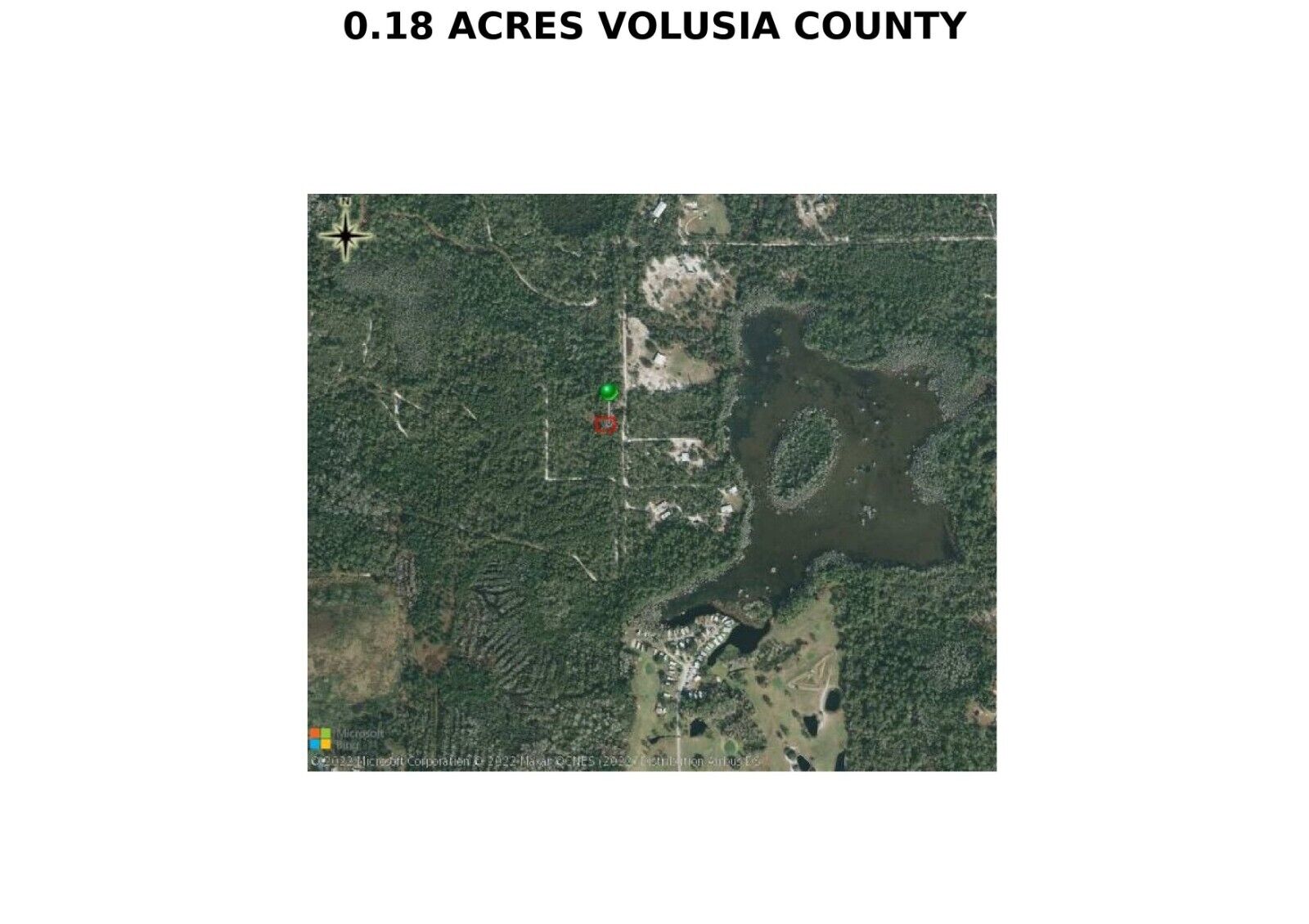

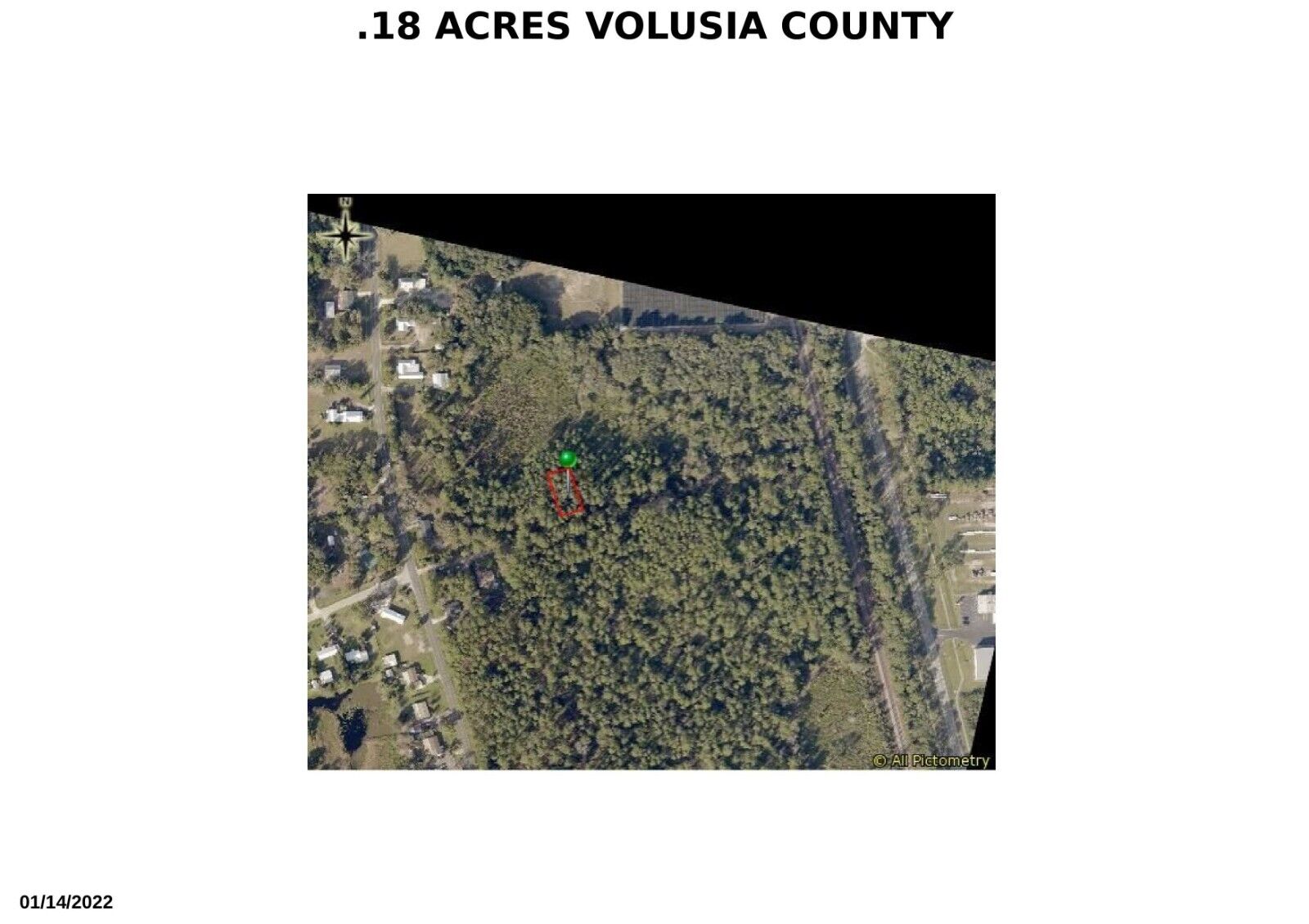

PICTURE IS AN ACCURATE EXAMPLE OF LAND LOCATION

=============================================================================================================================

LEGAL DESCRIPTION:

CANAVERAL GROVES SUBD PER SB 2 PAGE 60 BOOK 2 PG 60 TRACT 6 BLK 21 & 1/2 OF ADJ RDS PER ORB 1646 PG 130

CANAVERAL GROVES SUBD PER SB 2 PAGE 60 BOOK 2 PG 60 TRACT 6 BLK 21 & 1/2 OF ADJ RDS PER ORB 1646 PG 130

CANAVERAL GROVES SUBD PER SB 2 PAGE 60 BOOK 2 PG 60 TRACT 6 BLK 21 & 1/2 OF ADJ RDS PER ORB 1646 PG 130

CURRENT TAXES DUE UPON FORECLOSURE:

9.41

DATE ELIGIBLE FOR FORECLOSURE: 4/1/2023

======================================================================================================

Have you ever wondered how some middle income investors are able to accumulate multi-million dollar real estate holdings?

Invest in County Delinquent Tax Sale!

Only Banks and a handful of Real Estate Investors use this technique to accumulate a large amount of wealth!

Acquire valuable real estate from the first hands! Skip all the middle men! Get Prime Real Estate straight from County with a low price tag!

Get Valuable Real Estate for only Pennies on a Dollar!

“Why do people call this the best way to acquire real estate for pennies on the dollar?

Here is a rough comparison of how different types of people buy real estate:

The average Real Estate Buyer using a real estate agent (with a low level of effort required) will typically pay 110-150% of market value.

The skilled rehabber (with a very high level of effort required) will typically pay 75-80% of market value.

The sophisticated foreclosure auction buyer (with a low level of effort required) will typically pay 60-85% of market value.

The sophisticated tax deed auction buyer (with a low level of effort required) will typically pay 10-65% of market value

The sophisticated investor in the County Delinquent Tax Sales (with a moderate level of effort required) will typically pay 1-20% of market value! ”

=================================================================================================================================

HOW DO I BUY?

PLEASE MESSAGE ME FIRST

The process of the sale is simple and easy.

FIRST:

WHEN AUCTION CLOSES, YOU MUST MESSAGE ME TO COMPLETE TRANSACTION.

I WILL NOT MESSAGE YOU

SECOND: PLEASE Indicate which payment method you will be using

(MONEY ORDER, BANK CERTIFIED CHECK, PERSONAL CHECK) OR PAYPAL

(IF YOU CHOOSE PAYPAL AS A METHOD OF PAYMENT, PLEASE SEND YOUR EMAIL ADDRESS AND I WILL SEND YOU THE OFFICIAL INVOICE)

THIRD:

Once payment is confirmed, I will send you a link to obtain a free bidder number which is required by the county in order to transfer the tax lien certificate from my name over to you.

LASTLY:

Once you send me your bidder number and I transfer it over, the tax lien certificate is ALL yours!

If you have found my process simple and helpful, a positive review would be GREAT!

================================================================================================================================

PAYMENT:

The Transfer Documentation Fee of

5.00

will be added to your Final Bid Amount. The Total Payment is due within 3 business days.

The payment can be made by certified funds: Cashier's or Money Order Checks, Personal or Business checks.

The Document Transfer to Buyer from County takes about 1 DAY(BY ELECTRONIC MAIL) after payment clears.

TERMS and CONDITIONS:

Your bid is a binding contract to pay the amount of your bid if you are the winning bidder.

By bidding, you agree that you have:

a. Made ALL DUE DILIGENCE regarding the auction item and bidding accordingly; or

b. Waived your right(s) of doing your DUE DILIGENCE and are bidding at your own risk and on your own decision to do so;

c. Read and Agreed with current Terms and Conditions of this auction.

READ before you BID!

ASK ANY QUESTIONS NOW before you bid and buy!

We have listed all information accurately and to the best of our knowledge but you MUST do your OWN due diligence before you bid, NOT after the auction has closed.

IF you wait until AFTER you have won the auction to ask questions, we will NOT be responsible for your lack of due diligence!

All sales are final, no refunds will be given, unless the lien is redeemed during the transfer process. In any event, the seller reserves the rights to give a refund or substitute the item of similar value.

The 5.00 (non-refundable) documentation transfer fee will be added to the highest bid amount.

The auction starts at very low price, only {{detail_product_description}}.99! YOU set the winning bid amount in this auction.

The winning bidder MUST make a payment by certified funds as a Cashier's Check or Money Order(s), or Personal/Business Check. Payment due in 3 days after auction close.

If funds are not received within 3 days (unless you notify us to extend a payment due date), the winning bidder will be reported to eBay as a non-payer and/or have bidder’s eBay account being suspended and /or being responsible to pay any and/or all fees associated with posting this listing.

Please note that this auction is not a sale of the real property.

The winning bidder of this auction will receive a legal document, representing a first lien against the property

( Florida Statutes 197.102 (3)

and may

foreclose and gain title to the property

in accordance with The Florida Statutes 197.502 2498

THANK YOU FOR LOOKING AND BE SAFE!